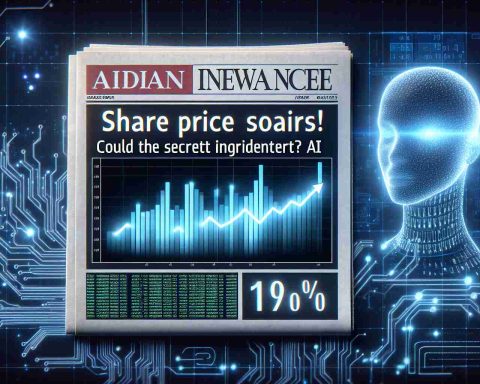

Palantir Technologies has been creating waves in December with its stock gaining 12.7% as confirmed by S&P Global Market Intelligence, positioning itself as one of the top stocks of 2024. Strategic partnerships and new defense contracts have played a significant role in this upward trajectory.

New Defense Contracts Fuel Growth

December proved to be a pivotal month for Palantir in the defense sector. A noteworthy partnership with Booz Allen Hamilton was announced on December 6, aimed at propelling U.S. defense technology to new frontiers. Following closely was the enhancement of their contract with the U.S. Special Operations Command, a lucrative one-year deal valued at $36.8 million.

Later in the month, Palantir secured an extended contract with the U.S. Army. This multi-year agreement overhauls the Army Data Platform with a projected value of approximately $400.7 million, and potential adjustments could see this figure rise to $618.9 million. Additionally, discussions surrounding a collaboration with Anduril hint at a groundbreaking defense consortium in the making.

Financial Momentum and Future Prospects

Palantir’s financial achievements continue to impress. In the third quarter alone, revenue surged 30% year over year to $726 million. The company’s net income soared, more than doubling to $149.3 million, while adjusted free cash flow tripled to $434.5 million. These figures reflect an impressive 20% net income margin and a 60% free-cash-flow margin.

While Palantir is on a robust growth path, the current valuation at 168 times expected earnings suggests potential volatility ahead. Investors should be mindful of the highly growth-dependent nature of Palantir’s market value as they consider its long-term potential.

Why Palantir Technologies is a Stock to Watch in 2024

Palantir Technologies is making significant strides in the technology and defense sectors, and December has been particularly noteworthy with its stock price seeing a remarkable increase. The company’s growth trajectory is fueled by strategic partnerships, robust financial performance, and promising defense contracts, cementing its status as a potential top stock for 2024.

Innovative Collaborations in Defense

Palantir’s recent collaborations signal a strategic move to cement its position in the defense industry. The partnership with Booz Allen Hamilton, announced on December 6, represents a concerted effort to enhance U.S. defense capabilities. Their enhanced engagement with the U.S. Special Operations Command further underscores Palantir’s commitment to supporting military operations with advanced technology solutions.

The extension of their contract with the U.S. Army is a landmark financial milestone, with projections hinting the deal could be valued up to $618.9 million. This partnership focuses on overhauling the Army Data Platform, ensuring seamless data integration and accessibility. This positions Palantir as a pivotal player in advancing military technology infrastructure.

Financial Growth and Market Positioning

Palantir’s impressive financial performance is a testament to its effective market strategies. The company’s revenue for the third quarter saw a 30% increase, reaching $726 million. Additionally, net income rose by more than twofold to $149.3 million. The company’s adjusted free cash flow notably tripled to $434.5 million, indicating strong operational efficiency with a 60% free-cash-flow margin.

Despite these promising developments, Palantir’s current market valuation at 168 times expected earnings introduces potential volatility. This high valuation underscores investor expectations for continued growth, implying sensitivity to market performance and adaptability to shifting industry dynamics.

Emerging Trends and Future Insights

Palantir’s trajectory is indicative of broader trends within the technology and defense sectors. The company’s efforts align with an increasing focus on data-driven solutions and national security initiatives. These trends position Palantir to advance in both defense technology innovation and commercial applications.

Moreover, ongoing discussions with Anduril suggest potential for a transformative defense sector partnership that could redefine technological collaborations in national security.

Overall, while Palantir offers promising growth prospects and stands on solid financial ground, investors should remain attentive to market fluctuations and evolving industry challenges. Keeping an eye on Palantir’s strategic maneuvers can offer valuable insights into both immediate capital gains and long-term growth potential.

For more information about Palantir’s advancements and opportunities, visit the Palantir Technologies website.