In a dramatic turn of events, Tesla has become a thrilling narrative of recovery after a rocky start in 2024. The electric vehicle giant struggled earlier in the year due to disappointing quarterly results and a general slowdown in EV sales across the industry. By late October, Tesla’s stock had plummeted 14% for the year, far underperforming the S&P 500, which enjoyed a 21% gain.

Things began to shift when Tesla unveiled a surprisingly robust third-quarter earnings report. The company’s profits soared, and CEO Elon Musk promised investors significant production increases for 2025, forecasting a 20% to 30% rise. This promising outlook sparked renewed investor confidence and ignited a remarkable stock rally.

The subsequent U.S. election further fueled Tesla’s ascent, with Musk aligning closely with then-President Trump. This political development invigorated hopes that the administration might introduce policies favorable to Tesla’s ambitious projects, including the highly anticipated Cybercab—a driverless robotaxi—and the budget-friendly Model Q, projected to cost under $30,000 when it launches in early 2025.

Despite the electric car maker’s rapid ascent, questions linger regarding Tesla’s lofty valuation. Trading at a staggering price-to-earnings ratio of 200, the company must rely on more than just vehicle sales to meet investor expectations. Musk’s vision for expanding Tesla’s autonomous vehicle segment is critical but fraught with obstacles, including regulatory challenges and intense market competition.

The feasibility of Musk’s partnership with Trump remains uncertain as policy inconsistencies could complicate Tesla’s path forward. While the possibility of relaxed regulations around self-driving technology presents a significant opportunity, it also carries inherent risks that could impact both Tesla and the administration.

Amid these dynamics, Tesla’s trajectory for 2025 remains unpredictable, with investors keenly watching whether the company can sustain its newfound momentum or if it’ll face another test of endurance in the coming year.

Tesla’s Strategic Moves: New Models, Partnerships, and Market Dynamics

In 2024, Tesla found itself at a crossroads, navigating through a series of challenges and opportunities that shaped its course for the future. The electric vehicle powerhouse faced a dip in confidence earlier in the year with lackluster quarterly results and an overarching decline in EV sales. Despite these hurdles, Tesla made an impressive rebound by late in the year, demonstrating its ability to adapt and thrive in a fluctuating market.

Innovations and Future Models

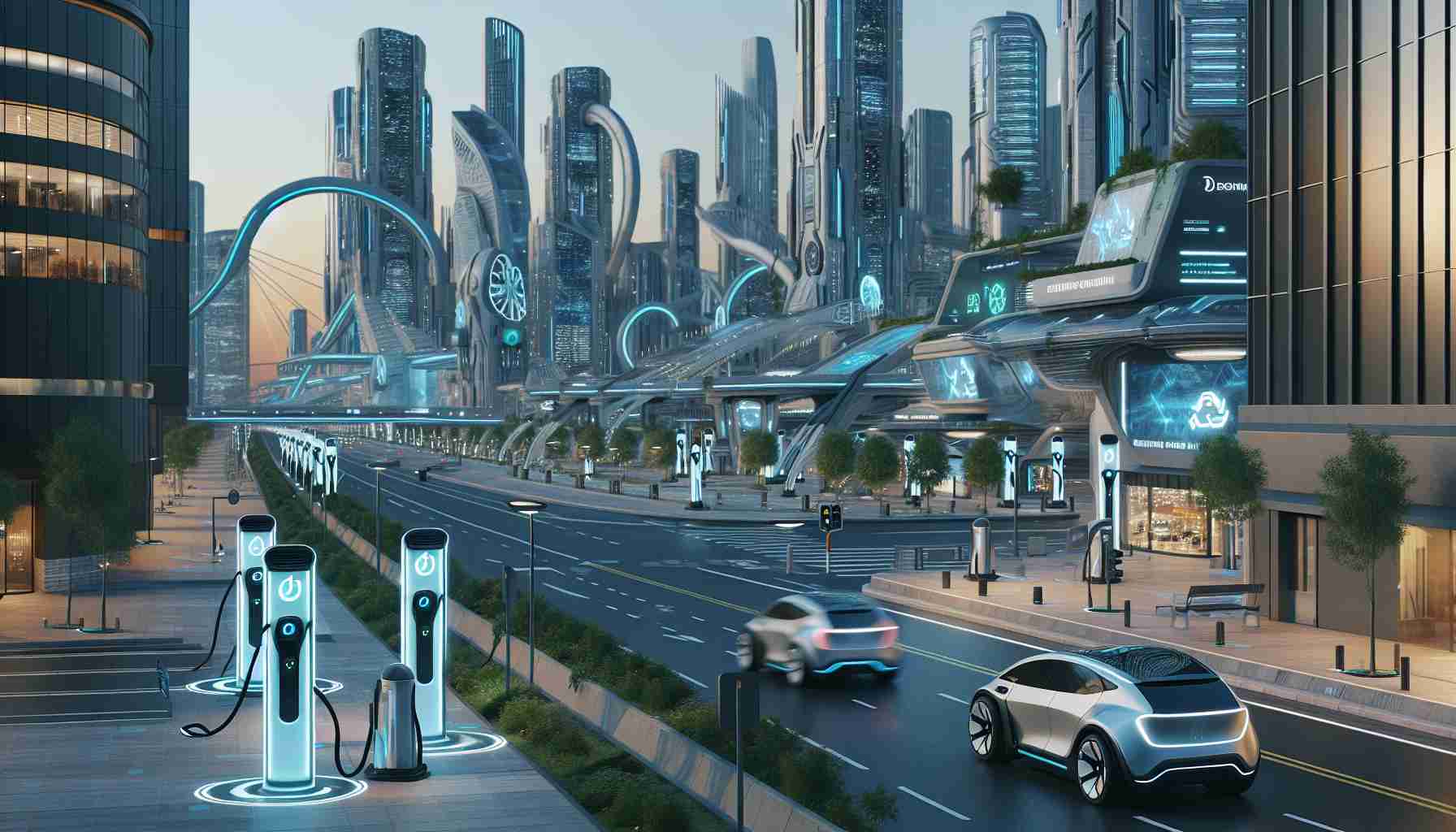

Tesla’s turnaround was largely driven by its commitment to innovation and product expansion. In the third quarter, the company reported soaring profits, largely attributed to projections of enhanced production capabilities by 2025. Among the upcoming releases, two models have particularly caught the public’s attention: the Cybercab, an autonomous robotaxi, and the Model Q, a budget-friendly EV aimed at a price point under $30,000.

# Features of New Models

Cybercab:

– Autonomous Driving Capabilities: The Cybercab is set to revolutionize urban transportation through its advanced self-driving technologies.

– Sustainability Focus: Tesla aims to manufacture the Cybercab with sustainable materials, further aligning with eco-friendly initiatives.

Model Q:

– Affordability: The Model Q addresses the market need for cost-effective electric vehicles, opening up Tesla’s offerings to a broader consumer base.

– Efficiency: With a projected high miles-per-charge ratio, the Model Q promises remarkable value and efficiency.

Pros and Cons of Expansion into Autonomous Vehicles

Pros:

– Market Leadership: Establishes a strong foothold in autonomous vehicle technology, positioning Tesla as a leader in innovation.

– Revenue Diversification: Provides new revenue streams apart from traditional vehicle sales.

Cons:

– Regulatory Hurdles: Navigating the regulatory landscape for autonomous vehicles remains a complex challenge.

– Competitive Pressure: Faces ongoing competition from other tech and auto companies investing heavily in similar technologies.

Strategic Political Alignment

Tesla’s interests have found an unexpected ally in former President Trump’s administration. This alignment has sparked discussions about governmental policies that could potentially favor Tesla’s initiatives, particularly in autonomous driving technologies and infrastructure development.

Economic Indicators and Predictions

Despite the significant gains in Tesla’s stock following its financial recovery and strategic announcements, the company’s valuation remains a subject of debate. Trading at a high price-to-earnings ratio underscores the market’s optimistic expectations for Tesla’s growth. However, investors are keenly aware of the need for sustainable growth beyond vehicle sales.

Market Analysis and Predictions

Moving forward into 2025, Tesla’s path is marked by both opportunities and uncertainties. The potential for relaxed regulations could pave the way for accelerated advancements in autonomous driving, yet such changes come with their own set of risks. Market analysts will be closely observing whether Tesla can maintain its upward momentum or face new challenges that test its resilience.

For more updates and details about Tesla’s innovative strides and market position, visit the official Tesla website.