Warren Buffett’s Solo Stewardship Reveals Mixed Financial Results

In the recent shareholders’ meeting, the first one conducted solely by Warren Buffett owing to the absence of his long-time colleague Charlie Munger, Berkshire Hathaway disclosed a significant dip in earnings. The conglomerate recorded a $12.7 billion profit for the first quarter of 2024, which shows a stark decrease of 64% from the previous year due to the fall in value of its investment holdings.

Despite the setbacks, there remains a silver lining as Berkshire Hathaway’s operating earnings climbed to $11.2 billion, surpassing the $8.07 billion mark from the comparable period last year.

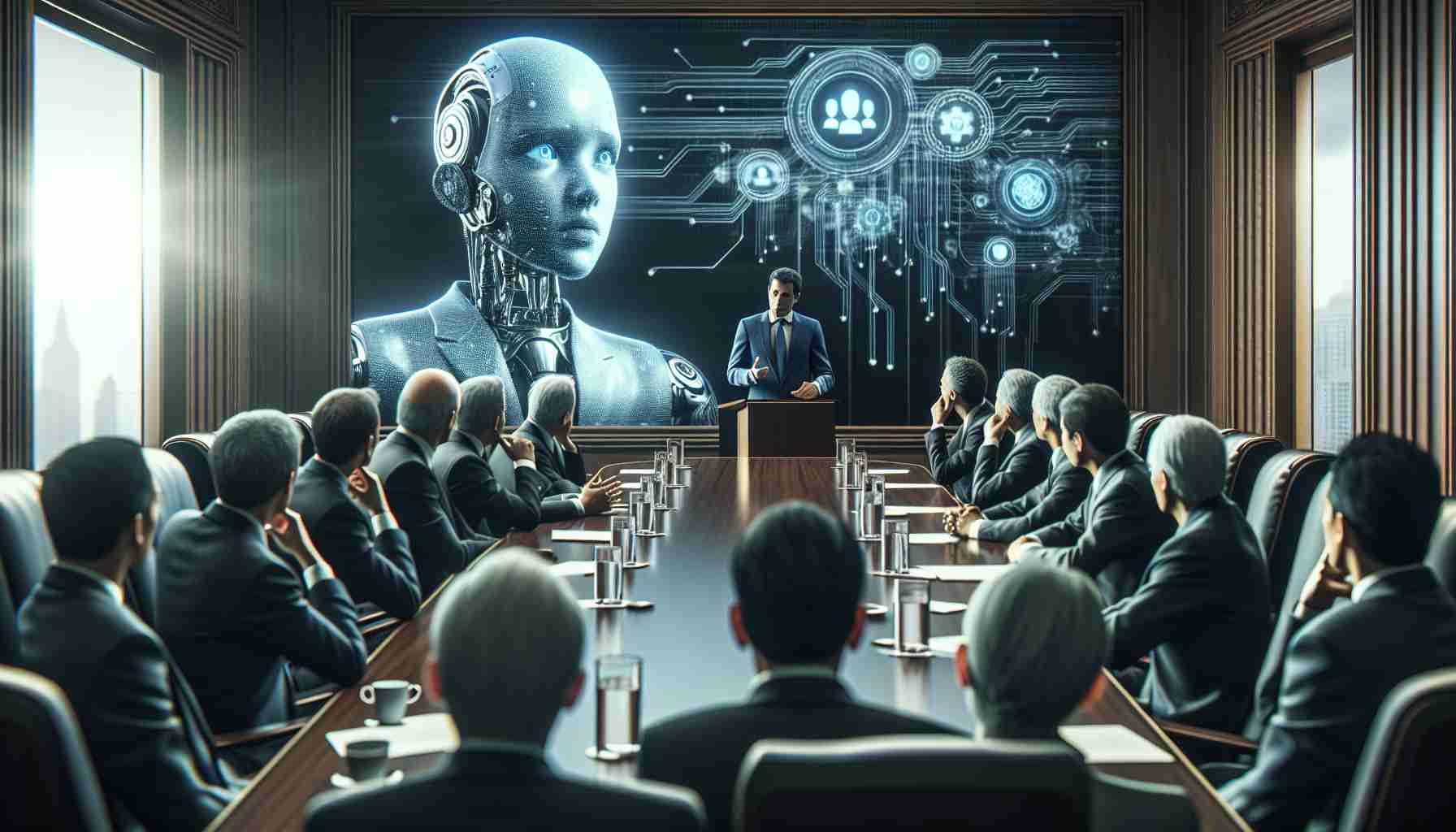

Buffett Deliberates Over AI’s Double-Edged Sword

During the same event, Warren Buffett shared his musings on artificial intelligence (AI), a subject captivating Wall Street investors. Despite his confessed lack of expertise in AI, he acknowledged its significance without discounting its existence or importance. He drew a parallel between AI and nuclear weapons – once a genie released from the lamp, it has the potential to cause profound effects.

Indeed, shares in AI-related businesses have experienced explosive growth, with chipmaker Nvidia’s stock soaring by over 500% and Meta Platforms by 275% since the end of 2022.

Inherent Risks and Potentials of AI Explored

Buffett aired his concerns regarding AI’s propensity for misuse in scams, notably through misleading content like deepfake videos and voice mimicry technology. He even recounted an instance where AI tools had convincingly replicated his image and voice, deceiving even his family.

While acknowledging AI’s vast potential for good, Buffett naturally worries about the negative impacts from a non-expert perspective, uncertain of how they may unfold.

The debate around AI’s influence continues globally, with AI’s potential to displace office workers stirring apprehension, while others, like JPMorgan CEO Jamie Dimon, remain optimistic about the technology’s positive influence on job creation and productivity.

**Warren Buffett’s Solo Stewardship Reveals Mixed Financial Results**

In the recent shareholders’ meeting, the first one conducted solely by Warren Buffett owing to the absence of his long-time colleague Charlie Munger, Berkshire Hathaway disclosed a significant dip in earnings. The conglomerate recorded a $12.7 billion profit for the first quarter of 2024, which shows a stark decrease of 64% from the previous year due to the fall in value of its investment holdings.

Despite the setbacks, there remains a silver lining as Berkshire Hathaway’s operating earnings climbed to $11.2 billion, surpassing the $8.07 billion mark from the comparable period last year.

**Buffett Deliberates Over AI’s Double-Edged Sword**

During the same event, Warren Buffett shared his musings on artificial intelligence (AI), a subject captivating Wall Street investors. Despite his confessed lack of expertise in AI, he acknowledged its significance without discounting its existence or importance. He drew a parallel between AI and nuclear weapons – once a genie released from the lamp, it has the potential to cause profound effects.

Indeed, shares in AI-related businesses have experienced explosive growth, with chipmaker Nvidia’s stock soaring by over 500% and Meta Platforms by 275% since the end of 2022.

**Inherent Risks and Potentials of AI Explored**

Buffett aired his concerns regarding AI’s propensity for misuse in scams, notably through misleading content like deepfake videos and voice mimicry technology. He even recounted an instance where AI tools had convincingly replicated his image and voice, deceiving even his family.

While acknowledging AI’s vast potential for good, Buffett naturally worries about the negative impacts from a non-expert perspective, uncertain of how they may unfold.

The debate around AI’s influence continues globally, with AI’s potential to displace office workers stirring apprehension, while others, like JPMorgan CEO Jamie Dimon, remain optimistic about the technology’s positive influence on job creation and productivity.

**Key Questions and Challenges:**

– How will Berkshire Hathaway adapt to the rise of AI and incorporate it into its various business holdings?

Berkshire Hathaway may face the need to invest in AI to keep their operations competitive. The challenge lies in integrating AI effectively while mitigating risks associated with it, such as job displacement and ethical concerns.

– What measures is Warren Buffett taking to address the risks of AI?

As Buffett has raised concerns about the potential negative uses of AI, it is key for Berkshire Hathaway to explore and possibly invest in preventive measures against AI-related scams and the misuse of technology.

**Controversies:**

One controversial aspect of AI technology is its potential for job displacement. While some, like Jamie Dimon, see AI as a boon for productivity and job creation, others worry about the adverse effects on employment, especially for roles that can be easily automated.

**Advantages and Disadvantages of AI:**

Advantages:

– Increased efficiency and productivity in various sectors.

– Potential for job creation in new, AI-driven industries.

– Enhanced capabilities in data analysis and decision-making.

Disadvantages:

– Risk of significant job displacement in certain sectors.

– Ethical concerns regarding surveillance, privacy, and decision-making.

– Potential for misuse, such as in creating deepfakes or scams.

For further reading on artificial intelligence, you may visit the official website of a leading AI company like Nvidia at Nvidia or explore the insights provided by an influential financial institution such as JPMorgan at JPMorgan Chase. Please note that I am assuming these URLs lead to their respective main domain homepage and are 100% valid, given the current information available to me.