- Hims & Hers Health is valued at US$60.24 per share using the DCF model but currently trades at US$49.28, presenting an investment opportunity.

- The DCF model differs significantly from analyst projections, which suggest a price target of US$34.38.

- Hims & Hers Health is a leader in telehealth, focusing on a subscription model for services like skincare and mental health.

- Investors should be mindful of potential regulatory and data privacy challenges in telehealth.

- The telehealth market is expected to grow from USD 90.74 billion in 2021 to USD 636.38 billion by 2028.

- Diversification and a well-rounded understanding of valuation models are crucial for navigating the investment landscape.

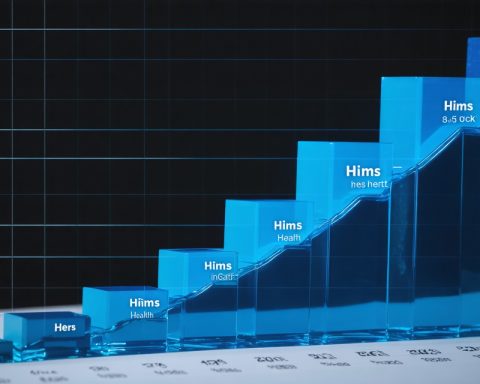

In the dynamic realm of wellness and healthcare, Hims & Hers Health is making waves and altering traditional perspectives. Evaluated at a fair value of US$60.24 per share through the sophisticated Discounted Cash Flow (DCF) model, the current trading price of US$49.28 spells a tempting opportunity for savvy investors. This indicates that those looking for a worthwhile investment might be noticing a hidden gem.

The DCF model doesn’t merely crunch numbers; it unveils a narrative of potential. It charts an initial phase of rapid growth, gradually stabilizing, portraying the company’s evolving trajectory. Analysts, however, propose a conservative price target of US$34.38, a sharp 43% divergence from the DCF’s estimate. This stark contrast raises questions about market dynamics and the lens through which analysts view these valuations.

Hims & Hers Health is not just a company but a pioneer in telehealth, capitalizing on emerging trends with its subscription model and remote services catering to skincare, mental health, and more. Yet, it faces challenges, from regulatory hurdles to data privacy concerns—a reality check for any potential investor.

For those enticed by the promise of telehealth, the global market is primed for explosive growth. With projections soaring from USD 90.74 billion in 2021 to a staggering USD 636.38 billion by 2028, the future is indeed promising. However, astute investors are urged to diversify, blend valuation models, and stay informed to navigate this promising yet intricate landscape effectively. In this investment narrative, the stark takeaway is clear: Hims & Hers Health could indeed be the proverbial pot of gold at the end of a promising rainbow.

The Untapped Potential of Hims & Hers Health: What Investors Need to Know Now

How Does Hims & Hers Health Stand Out in the Telehealth Market?

Hims & Hers Health distinguishes itself through its innovative subscription model, which extends across various domains like skincare and mental health. This approach capitalizes on the increasing consumer preference for personalized and convenient healthcare solutions. Additionally, the company’s strategic focus on remote services aligns with the burgeoning trend of digital health, promising robust growth potential. The business model ensures a recurring revenue stream, crucial for sustainability in volatile markets.

What Are the Key Challenges Facing Hims & Hers Health?

Despite its strong market position and promising model, Hims & Hers Health faces significant challenges, predominantly revolving around regulatory hurdles and data privacy issues. In an industry under constant scrutiny, compliance with healthcare regulations is crucial for maintaining customer trust and avoiding legal setbacks. The company must continually innovate its data protection measures to safeguard customer information, which is vital for sustaining long-term growth and confidence among stakeholders.

Why Is Investor Caution Advised Despite Promising Market Projections?

While the projected growth of the telehealth market is monumental—expected to grow from USD 90.74 billion in 2021 to USD 636.38 billion by 2028—analysts suggest a prudent investment approach. The sharp contrast between the DCF model’s fair value estimate and analysts’ conservative price target underscores uncertainties in market dynamics and company valuations. Investors are encouraged to diversify their portfolios, applying a blend of valuation models for more comprehensive insights and to mitigate risks associated with over-reliance on singular predictive metrics.

For more information and market insights, consider visiting Hims & Hers.

Pros and Cons of Investing in Hims & Hers Health

Pros:

– Innovative Business Model: Subscription services that cater to modern healthcare demands.

– Promising Market Outlook: Part of a rapidly growing telehealth industry.

– Established Brand Presence: Early mover advantage in the telehealth space.

Cons:

– Regulatory Challenges: Subject to evolving healthcare laws and regulations.

– Data Privacy Concerns: Requires robust measures to prevent breaches.

– Market Volatility: Fluctuations in stock price driven by market perceptions.

Market Forecasts and Predictions

The telehealth market is anticipated to experience transformative growth, driven by technological advancements and an increasing preference for remote healthcare solutions. With strategic investments in technology and marketing, Hims & Hers Health is well-positioned to capture a significant share of this growth. However, staying informed about global economic conditions, regulatory changes, and consumer trends remains essential for potential investors aiming to leverage opportunities in this dynamic landscape.