The financial markets experienced a significant upturn on Friday, driven by a revival in technology stocks as investors reacted positively to a week filled with essential economic data and corporate earnings reports. The Dow Jones Industrial Average recorded a rise of 0.8%, while the S&P 500 advanced by 1%. The Nasdaq Composite, noted for its tech-heavy composition, surged 1.5%, with notable contributions from tech giants like Nvidia and Tesla.

Investor optimism was bolstered by solid earnings from major banks and favorable inflation figures, leading to renewed expectations for future interest rate cuts. Key market indices finished the week on a high note, with the Dow up 3.7%, the S&P 500 gaining 2.9%, and the Nasdaq climbing 2.4%. The 10-year Treasury yield also fell, settling around 4.6%.

New economic indicators pointed to a stronger-than-anticipated recovery in the U.S. economy, with an increase in housing starts and robust industrial production figures released on Friday. Another highlight was the tech sector’s revival, as companies like Apple and several chipmakers saw their stock prices rise.

Looking ahead, the markets brace for significant changes with President-elect Donald Trump’s upcoming inauguration, stirring discussions around potential policy shifts that could influence inflation and economic growth. As traders prepare for the Martin Luther King Jr. holiday, all eyes will be on the unfolding developments in the coming weeks.

Implications of Financial Market Resilience

The recent resurgence in financial markets, particularly within the technology sector, signifies more than just short-term gains; it could reshape societal and cultural attitudes towards investments and economic stability. Increased confidence in tech stocks not only reflects investor sentiment but also influences how younger generations perceive wealth creation. This edge towards technology-driven investments is likely to spur a broader cultural shift, with more individuals gravitating towards tech literacy and entrepreneurship.

Furthermore, these market dynamics impact the global economy, as U.S. market trends often ripple across international borders. Major markets in Europe and Asia closely monitor American stock performance for clues on their economic strategies. As emerging markets increasingly integrate technology into their economies, any fluctuations in the U.S. could directly affect their growth trajectories and investment climates.

On an environmental front, investor focus on companies demonstrating sustainability and corporate responsibility is on the rise. More tech companies are prioritizing eco-friendly practices, potentially driving innovation in green technology. This trend not only provides economic opportunities but also highlights the long-term significance of investing in a sustainable global economy.

Looking ahead, as we approach pivotal political changes, the markets may pivot to address new challenges, focusing on long-term resilience and the adaptation of cutting-edge technologies that promise to redefine economic landscapes. The evolving interplay between market performance and cultural perceptions will be crucial in shaping both the economy and investment strategies in the years to come.

Financial Markets Surge: What Investors Need to Know About the Latest Trends

Overview of Recent Market Trends

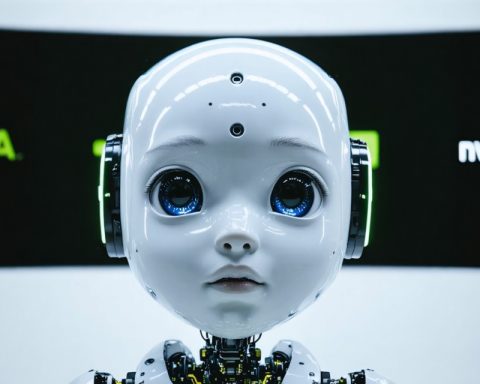

The financial markets recently experienced a robust upward movement, particularly in technology stocks, driven by favorable economic data and positive corporate earnings reports. The Dow Jones Industrial Average increased by 0.8%, while the S&P 500 rose by 1%. The Nasdaq Composite, heavily weighted with technology companies, witnessed a notable surge of 1.5%, bolstered by the strong performance of tech giants such as Nvidia and Tesla.

Key Economic Indicators

Recent economic indicators suggest a much stronger-than-expected recovery in the U.S. economy. Key highlights include:

– Housing Starts: There has been a significant rise in housing starts, indicating a rebound in the real estate market.

– Industrial Production: Robust industrial production figures demonstrate increased manufacturing activity.

These positive developments have helped improve investor sentiment, as evidenced by the overall gains for major market indices, with the Dow up 3.7%, the S&P 500 gaining 2.9%, and the Nasdaq climbing 2.4% for the week.

Interest Rate Outlook

The decline in the 10-year Treasury yield, now around 4.6%, contributes to a renewed sense of optimism among investors. Many are anticipating possible interest rate cuts in the coming months, particularly in light of favorable inflation data and strong earnings from major banks.

Tech Sector Revival

The resurgence of the tech sector is notable, driven by increases in stock prices from major players such as Apple and various semiconductor manufacturers. This trend has significant implications for investors, particularly those focusing on technology as a key growth area.

Future Considerations

Looking ahead, the upcoming presidential inauguration is set to introduce new policies that may influence inflation rates and overall economic growth. Investors are keenly observing potential changes that the new administration may bring, particularly in areas impacting fiscal policy and market regulations.

Market Strategies

Pros and Cons of Investing in Technology Stocks

– Pros:

– Strong recovery indicators in the tech sector.

– Continued innovation driving growth.

– Potential for high returns due to market dominance by leading tech companies.

– Cons:

– Possible market volatility related to broader economic policy changes.

– High valuation levels in tech stocks can lead to corrections.

Predictions and Trends

As the markets prepare for the Martin Luther King Jr. holiday, expectations are high for continued volatility as investors assess the impact of forthcoming policy announcements. Analysts predict that tech stocks will continue to play a pivotal role in market performance, with a focus on innovative companies leading the way.

Conclusion

Investors should stay informed about these developments, as they will play a crucial role in shaping market conditions. Keeping an eye on economic indicators, interest rate trends, and significant policy shifts can provide essential insights for making informed investment decisions.

For more insights and detailed updates on financial markets, visit Finance News.