As the trading year draws to a close, savvy investors are turning their attention to potential winners in 2025. The financial experts at William Blair have spotlighted several stocks primed for growth in the coming year. Despite an already impressive 2024, some stocks are set to reach new heights.

This year has been remarkable for major indexes. The Nasdaq Composite led the charge with a stunning 33% increase, followed by the S&P 500 at 26%, and the Dow Jones with a 14% gain. As we anticipate the new year, William Blair’s insights offer some compelling stock picks.

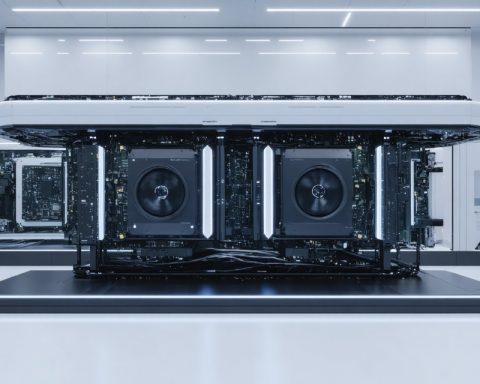

Broadcom has been a powerhouse, surging 47% in December alone and achieving a staggering 114% increase throughout 2024. The semiconductor giant recently hit a significant milestone with a market cap exceeding $1 trillion. Broadcom’s future looks bright, with custom AI chip developments for major cloud providers and partnerships with tech giants like ByteDance, OpenAI, and Apple.

In the pet retail sector, Chewy has outperformed expectations, boasting a 48% rise this year. The company is well-positioned to benefit from an industry recovery and the ongoing normalization of online shopping, which is expected to boost customer growth in 2025.

Small-cap biotech Neurogene also shows promise. After a 16% rise in 2024, the company is set for significant developments with its NGN-401 gene therapy for Rett syndrome. Key announcements are anticipated in 2025, potentially driving stock value higher, especially with FDA’s recent endorsement.

Additional stocks to watch include Carvana and Viking Therapeutics, which have already experienced remarkable growth in 2024. Investors may find these William Blair recommendations worthy of consideration for a prosperous 2025.

Which Stocks Are Set to Soar in 2025?

As investors look forward to 2025, they are keen on identifying stocks with strong growth potential. This article synthesizes insights and predictions for the coming year, focusing on promising companies that could deliver remarkable gains.

Broadcom: Innovation in the Semiconductor Industry

Broadcom stands out as a major player in the semiconductor sector, especially after achieving over a 114% increase in 2024 and crossing the $1 trillion market cap threshold. With ongoing developments in custom AI chips tailored for leading cloud providers, Broadcom is poised for further expansion. Collaborations with tech giants such as ByteDance, OpenAI, and Apple enhance its growth prospects. These partnerships are likely to fuel continued success as demand for AI-driven technologies increases.

Chewy: Riding the Wave of Online Shopping in the Pet Industry

Chewy has capitalized on the recovery of the pet retail sector and the normalization of online shopping, resulting in a stellar 48% rise this year. Looking ahead to 2025, Chewy’s ability to expand its customer base remains strong. The company is leveraging digital trends and increasing pet ownership rates, positioning itself to tap into sustained growth as e-commerce becomes further embedded in consumer behavior.

Neurogene: A Biotech on the Brink of Breakthroughs

Neurogene is another noteworthy contender, particularly in the realm of biotech. With a promising 16% surge in 2024, the company is ahead in the development of NGN-401, a gene therapy for Rett syndrome. The expected FDA announcements in 2025 could act as a catalyst for the stock. As biotechnological innovations advance, Neurogene’s strategic focus on niche therapeutic areas highlights its potential for significant returns.

Emerging Stocks to Watch: Carvana and Viking Therapeutics

In addition to the above-mentioned stocks, Carvana and Viking Therapeutics have demonstrated impressive growth in 2024. As the automotive and pharmaceutical sectors undergo transformations, these stocks are positioned to benefit from shifting market dynamics. Investors looking for diversification may find their strategic positions and innovative approaches attractive for 2025.

Market Trends and Predictions for 2025

The financial landscape is rife with opportunities, driven by technological advancements and sector-specific recoveries. As we anticipate 2025, strategic investments in companies that lead in their respective fields offer substantial potential. Whether capitalizing on AI trends in tech, the surge in e-commerce, or breakthroughs in biotechnology, the coming year promises to reward those who are proactive and informed.

For more information and insights, visit the investment experts at William Blair.