Understanding Investment Strategies: Unveiling the Secrets

To make informed investment decisions, it’s crucial to delve deep into the workings of a company. This involves two critical steps. First, understanding the company’s revenue streams is essential. Every potential investor must look beyond surface-level knowledge of a brand and dig into how it truly earns its money. For instance, Amazon is not just an e-commerce site but also leads the market in cloud computing and has a burgeoning ad business. Likewise, Alphabet, known for its free consumer products, generates its primary income through advertisements, cloud services, and its innovative Waymo project.

To gain this knowledge, investors can turn to the company’s investor relations websites for detailed presentations and annual filings. Consider the customer base and whether the offerings are essential or discretionary. Assess the competition and difficulty for customers to switch to rival brands.

Analyzing Financial Health

After grasping a company’s business model, the next step is to scrutinize its financial statements. The balance sheet, income statement, and cash flow statement are pivotal documents that offer insights into a company’s financial health. Initially, focus on the balance sheet to determine if the company can cover its liabilities with its assets, specifically short-term debts, over the following year. A robust balance sheet indicates a positive outlook for the company.

Effective investors know these processes are ongoing, requiring continuous learning and adaptation. By mastering these steps, you set a strong foundation for making informed investment choices.

Life Hacks for Savvy Investing: Maximizing Your Financial Decisions

Embarking on the journey of investment can be both thrilling and daunting. To thrive in the investing world, it’s crucial not only to understand core strategies but also to apply clever tips and life hacks that will give you an edge. Here are some practical insights and intriguing facts to enhance your investment approach.

1. Diversify Your Portfolio Wisely

While diversification is a fundamental principle, it’s essential to be strategic about it. Diversify not just across assets, but think globally. Consider international markets and not just your home country. This can reduce risk while potentially increasing your returns.

2. Leverage Technology

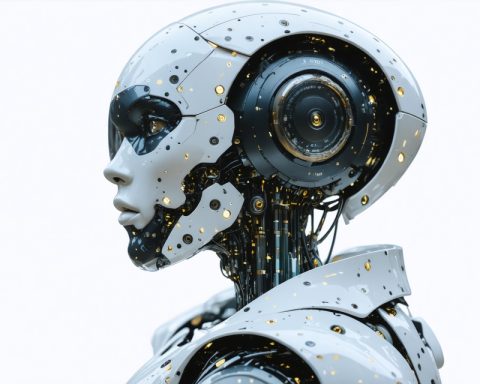

Today, technology offers myriad tools to streamline your investing process. Utilize financial apps and platforms that provide real-time data, personalized alerts, and insights. Consider using robo-advisors for balanced portfolios with lower fees compared to traditional advisors. Many of these services can help you grasp investment trends with comprehensive analytics.

3. Learn from the Experts

Listening to successful investors can provide invaluable learning. Read books by renowned investors and follow their talks and advice. Programs like MasterClass and webinars from leading universities can offer expert insights.

4. Tax Efficiency is Key

Understanding how investment gains are taxed can significantly affect your returns. Consider the implications of capital gains tax and explore tax-advantaged accounts like Roth IRAs or 401(k)s to maximize your portfolio’s efficiency.

5. Invest Regularly, Regardless of Market Conditions

One of the simplest yet most effective investment strategies is dollar-cost averaging. By consistently investing a fixed amount, you buy more shares when prices are low and fewer when prices are high, mitigating the impact of market volatility.

6. Stay Updated with Industry News

Keep abreast of news in sectors you’re invested in. Regularly visiting sites like Bloomberg or following financial news can help you stay informed about market shifts and adjust your strategy accordingly.

Interesting Fact: The Power of Compound Interest

An often-quoted gem by Albert Einstein calls compound interest the “eighth wonder of the world.” The magic of compound interest lies in its ability to exponentially grow your wealth over time. For example, investing a modest amount consistently while reinvesting dividends can lead to substantial growth.

Strategic Learning and Adaptation

Ultimately, the most successful investors are those who continuously learn and adapt to changing markets. Use these tips as stepping stones. Always question and refine your approaches as you gather more insights along your investment journey.

Remember, successful investing is not just about following trends but understanding the underlying principles and adapting them to suit your financial goals and risk tolerance.