ASML, a Dutch company renowned for manufacturing lithography machines, has caught the attention of investors as a prominent player in the semiconductor industry. With its significant revenue growth and solid gross margins, ASML stands out as a pick-and-shovel semiconductor stock. Despite being a hardware company with a market cap of nearly $280 billion, ASML has managed to navigate the complex business landscape successfully.

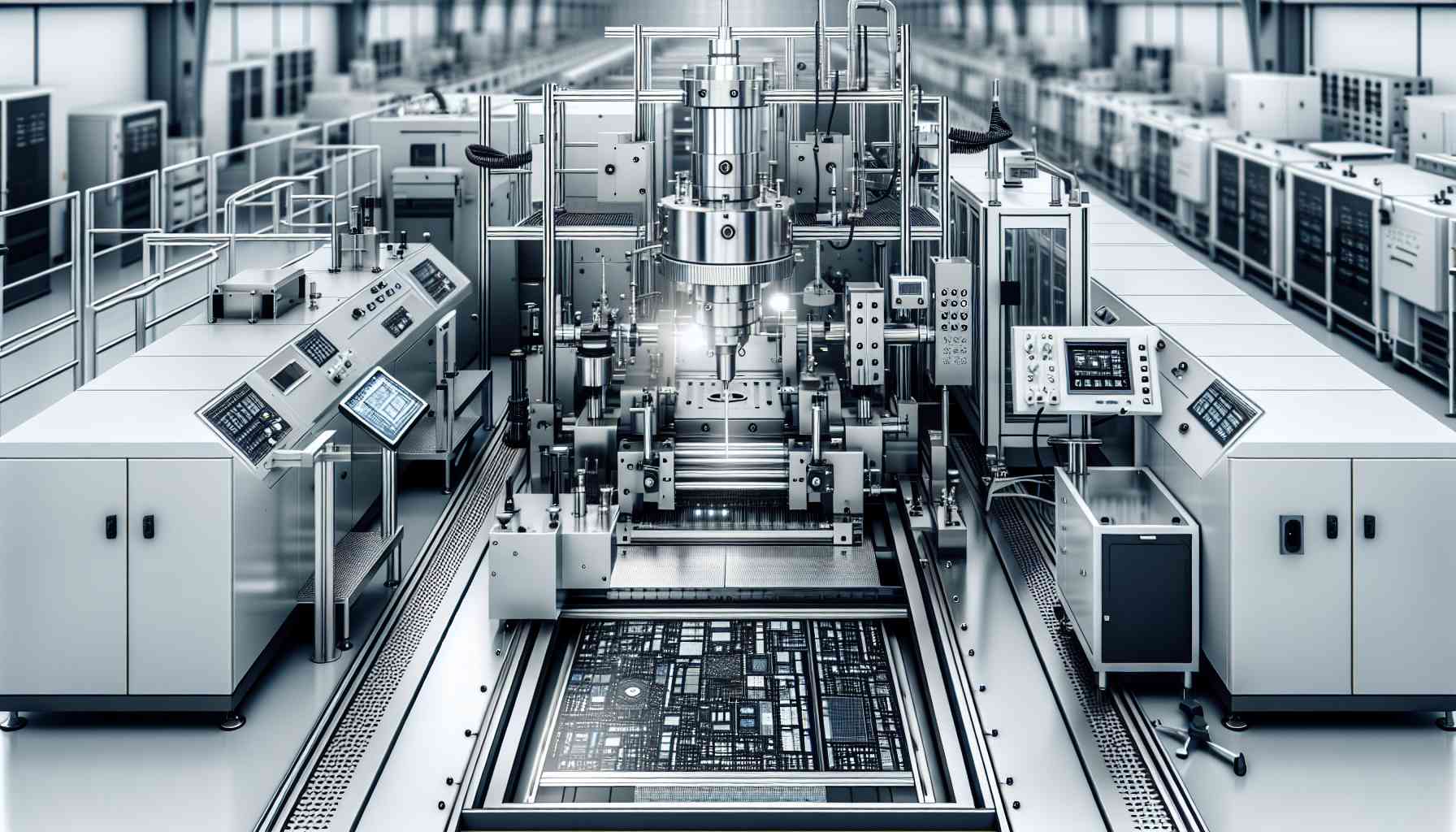

The demand for advanced computer chips at scale has driven the need for efficient lithography machines, making ASML’s products crucial in the semiconductor manufacturing process. These machines play a vital role in producing high-quality chips and are widely used by companies across the globe.

Although ASML’s success cannot be denied, it faces certain challenges that could impact its growth potential. One such challenge arises from the regulatory risks imposed by a U.S. export ban on specific chip technologies to China. This ban has introduced obstacles for ASML’s expansion into the Chinese market, which could have otherwise provided lucrative growth opportunities.

Despite these challenges, ASML has remained resilient and has continued to deliver impressive financial performance. Its innovative technologies and strategic partnerships have contributed to its dominance in the market. ASML’s dedication to research and development has allowed it to stay ahead of its competitors, solidifying its position as the leading manufacturer of lithography machines.

While ASML’s success is evident, investors must carefully consider the risks associated with its regulatory challenges. Diligent research and a comprehensive understanding of the company’s position within the semiconductor industry are essential for any investor considering ASML as part of their portfolio.

In conclusion, ASML’s remarkable growth and strong market position make it a noteworthy player in the semiconductor industry. As the leading manufacturer of lithography machines, ASML has successfully capitalized on the increasing demand for advanced computer chips. However, investors should remain cautious regarding the regulatory risks that may impact the company’s future prospects.

The source of the article is from the blog rugbynews.at