- Tesla faces a challenging year with shares down 28%, reflecting slowing momentum and diminishing investor confidence.

- Concerns are fueled by underwhelming fourth-quarter financials, historic low in annual deliveries, and scrutiny over self-driving technology.

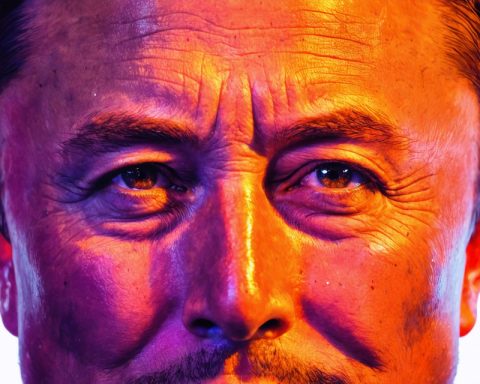

- Elon Musk’s political entanglements and outspoken nature risk alienating potential buyers and add to investor uncertainty.

- Tesla’s stock volatility continues, but missteps and market challenges suggest deeper issues.

- Hope stems from upcoming innovations like the revamped Model Y, an affordable EV, and robotaxi trials in Austin, Texas.

- Investors question whether Tesla can regain its previous success amidst current market and political complexities.

Tesla, once a darling of Wall Street, finds itself caught in a whirlwind of unpredictability. With shares down 28% this year, this tech titan is navigating turbulent waters as it grapples with slowing momentum and bruised investor confidence. As Elon Musk, the outspoken CEO who also helms the Department of Government Efficiency (DOGE), rallies government employees to demonstrate their weekly contributions, investors are left pondering Musk’s own efficacy in steering Tesla’s monumental ship.

This decline isn’t just a fleeting phase. With Tesla nearly relinquishing its post-2016 election stock gains—back when Donald Trump’s ascendancy was a boon thanks to Musk’s strategic alignment—investors question the sustainability of such political ties. Tesla’s market capitalization, once soaring beyond a trillion dollars, now limps below that threshold, highlighting the gravity of its current predicament.

Several missteps have fueled this descent. Tesla’s fourth-quarter financials, which failed to dazzle, coupled with a historic fall in annual deliveries, sowed seeds of doubt. Further scrutiny from the National Highway Traffic Safety Administration over its self-driving technology and lukewarm reception to the Cybertruck have magnified these concerns. In Europe, sluggish sales figures in January added to the dismay among shareholders.

Musk’s political entanglements further complicate matters. His unabashed commentary and polarizing political ventures abroad risk alienating potential buyers and raise questions about his focus. While Tesla’s stock has historically been volatile, recent erratic behavior suggests deeper issues beneath the surface.

Yet, hope isn’t entirely forsaken. Tesla’s introduction of the revamped Model Y and hints of a more affordable electric vehicle buoy investor spirits. The anticipated launch of unsupervised robotaxi trials in Austin, Texas, come June, entices with the promise of innovation. Such developments offer glimmers of optimism that could reignite Tesla’s flame.

In a world dictated by challenges and change, Tesla trudges on, a narrative etched not just in numbers but in the vision of a future still to be defined. As Musk maneuvers through the mire of political and market complexities, the pivotal question remains: Will Tesla chart a course back to glory, or will it remain enveloped in its current tempest? For investors, the saga continues, with stakes as high as the aspirations Tesla promises.

Can Tesla Revive Its Fortunes Amidst Market Challenges and Political Entanglements?

As Tesla navigates through a whirlwind of market setbacks and political complexities, investors and enthusiasts alike are left pondering the company’s future. Here’s an in-depth exploration of the key factors at play, insights into market trends, and potential strategies for turning the tide.

Pressing Questions and Key Insights

1. What Factors Contributed to Tesla’s Current Predicament?

– Financial Performance: Tesla’s lackluster fourth-quarter results and a notable slowdown in annual deliveries have induced skepticism among investors.

– Regulatory Challenges: Increased scrutiny over Tesla’s self-driving technology by the National Highway Traffic Safety Administration (NHTSA) has raised safety concerns.

– Product Reception: Tepid responses to the Cybertruck and slow sales in Europe have further dampened investor confidence.

– Political Involvement: Elon Musk’s political ventures and outspoken commentary have the potential to alienate certain customer segments.

2. Can Product Innovations Spark a Rebound?

Tesla has several new developments that offer hope:

– Revamped Model Y: The introduction of a refreshed Model Y could entice both existing and new customers.

– Affordable EV Plans: Speculation around a more cost-effective electric vehicle could expand Tesla’s market reach.

– Robotaxi Trials: Scheduled unsupervised robotaxi trials in Austin, Texas, highlight Tesla’s ongoing innovation in autonomous driving.

3. How Might Market Trends Influence Tesla’s Future?

– Electrification and Sustainability: As the global push for sustainable energy strengthens, Tesla can leverage its brand to capitalize on growing electric vehicle demand.

– Competitor Landscape: With major automakers ramping up EV production, Tesla must innovate continually to maintain its competitive edge.

How-To Steps & Life Hacks for Investors

– Diversify Your Portfolio: Given Tesla’s volatility, investors should consider diversifying to offset potential risks.

– Stay Informed: Keep abreast of company announcements, regulatory changes, and market trends to make well-informed decisions.

– Long-Term Perspective: Focus on Tesla’s long-term potential rather than short-term fluctuations.

Pros & Cons Overview

Pros:

– Innovative product lineup and technological advancements.

– Strong brand presence in the electric vehicle market.

Cons:

– Stock volatility and market unpredictability.

– Regulatory and safety scrutiny regarding autonomous technologies.

– Potential alienation due to CEO’s political involvement.

Actionable Recommendations

1. Monitor Regulatory Developments: Keep an eye on Tesla’s interactions with the NHTSA, as regulatory outcomes can significantly impact stock performance.

2. Evaluate Product Acceptance: Track consumer reception to new Tesla models and robotaxi trials for potential market impact.

3. Adjust Strategies Based on Market Trends: Adapt investment strategies according to shifts in the EV market and competitive landscape.

Related Links

For further information on electric vehicles and industry trends, visit [Tesla](https://www.tesla.com).

Conclusion

Tesla’s journey is emblematic of the broader challenges inherent in disruptive innovation. While current market pressures and political entanglements present hurdles, the company’s endeavors in product innovation and expansion into autonomous mobility may yet herald a revival. For investors, the path forward requires a balance between caution and optimism, informed by a keen understanding of both market dynamics and Tesla’s evolving narrative.